louisiana inheritance tax waiver form

The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. Addresses for Mailing Returns.

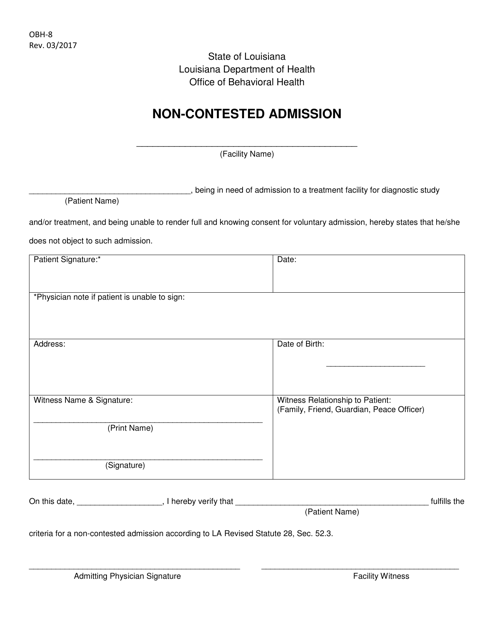

Form Obh 8 Download Printable Pdf Or Fill Online Non Contested Admission Louisiana Templateroller

What is a inheritance tax waiver form.

. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Louisiana does not impose any state inheritance or estate taxes. The federal estate tax is due nine months from the date of death and is currently filed when assets exceed 5450000 for decedents dying in the 2016 tax year.

Inheritance tax An original inheritance tax return is to be filed in the succession record. This form covers the death of the second spouse to die. Does Oklahoma require an inheritance tax waiver form.

Often in Louisiana one person will inherit the right to use property and receive the fruits income from property. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. Select Popular Legal Forms Packages of Any Category.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. 1 Total state death tax credit allowable Per US. As of the spring of 2011 the district of columbia and 34 states do not require an inheritance tax waiver be prepared.

Louisiana Inheritance Tax WaiverAn inheritance tax is one thats imposed on heirs when they receive assets from a deceased persons estate. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. Who is entitled to an inheritance tax waiver in Florida.

Oklahoma Waiver required if decedent was a legal resident of Oklahoma. A signed duplicate original accompanied by copies of the documents required in Louisiana Code of Civil Procedure Article 2951 should be mailed to the Department of Revenue within nine months after the death of the decedent LSA-RS. All groups and messages.

A Louisiana Inheritance Tax Return would also be needed in most cases and in some cases a federal Estate Tax Return will be required. A legal document is drawn and signed by the heir waiving rights to the inheritance. Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO HEREBY CERTIFY that an heir executor administrator attorney or other legal representative of the succession or.

LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life insurance beneficiaries to provide that the holder would not be responsible for any Louisiana inheritance tax owed on the property and that LDR will only pursue payment of the tax against. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and. For current information please consult your legal counsel or.

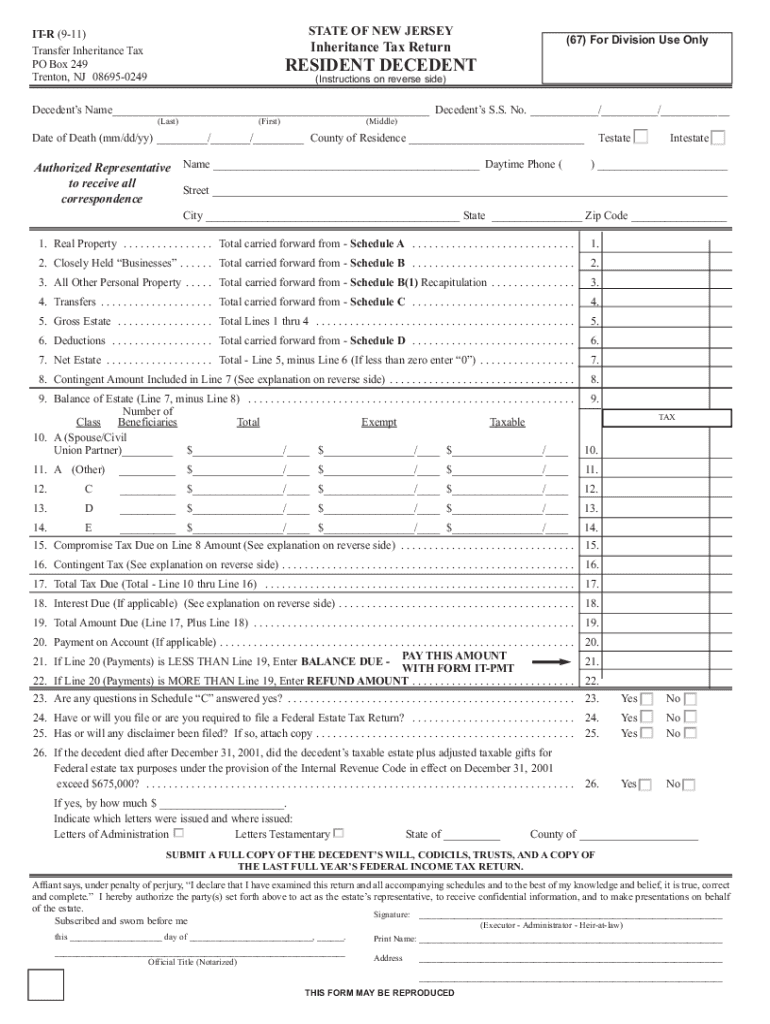

What is inheritance tax waiver form. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. The New Jersey Inheritance Tax Bureau issues tax waivers after an Inheritance or Estate Tax return has been filed and approved by the Bureau.

Succession is accepted unconditionally but see LA RS. In order to understand Louisiana inheritance law you need to be familiar with the legal terms usufruct and usufructuary. Social Security numbers of heirs are shown in the affidavit of valuation.

Does Louisiana impose an inheritance tax. State of Louisiana Department of Revenue PO. Its also a community property estate meaning it considers all the assets of a married couple jointly owned.

How to apply Louisiana community property law to an estate Forced Heirship and spousal usufructs under Louisiana law Laws relating to Louisiana inheritance tax estate tax and gift tax This guide is divided into short chapters to help you find answers to your questions as quickly as possible. This right is called a usufruct and the person who inherits this right is called a usufructuary. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. What is an inheritance tax waiver in NJ. Find out when all state tax returns are due.

All Major Categories Covered. No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released.

This ratio is applied to the state death tax credit allowable under Internal Revenue Code Section 2011. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency.

Effective January 1 2012 no receipts will be issued for inheritance tax regardless of the date of death. If youre looking for more guidance to navigate the complexities of Louisiana inheritance laws reading up on them beforehand will be a huge help. BUT no waiver is required for any property passing to the surviving spouse either through the estate of the decedent or by joint tenancy.

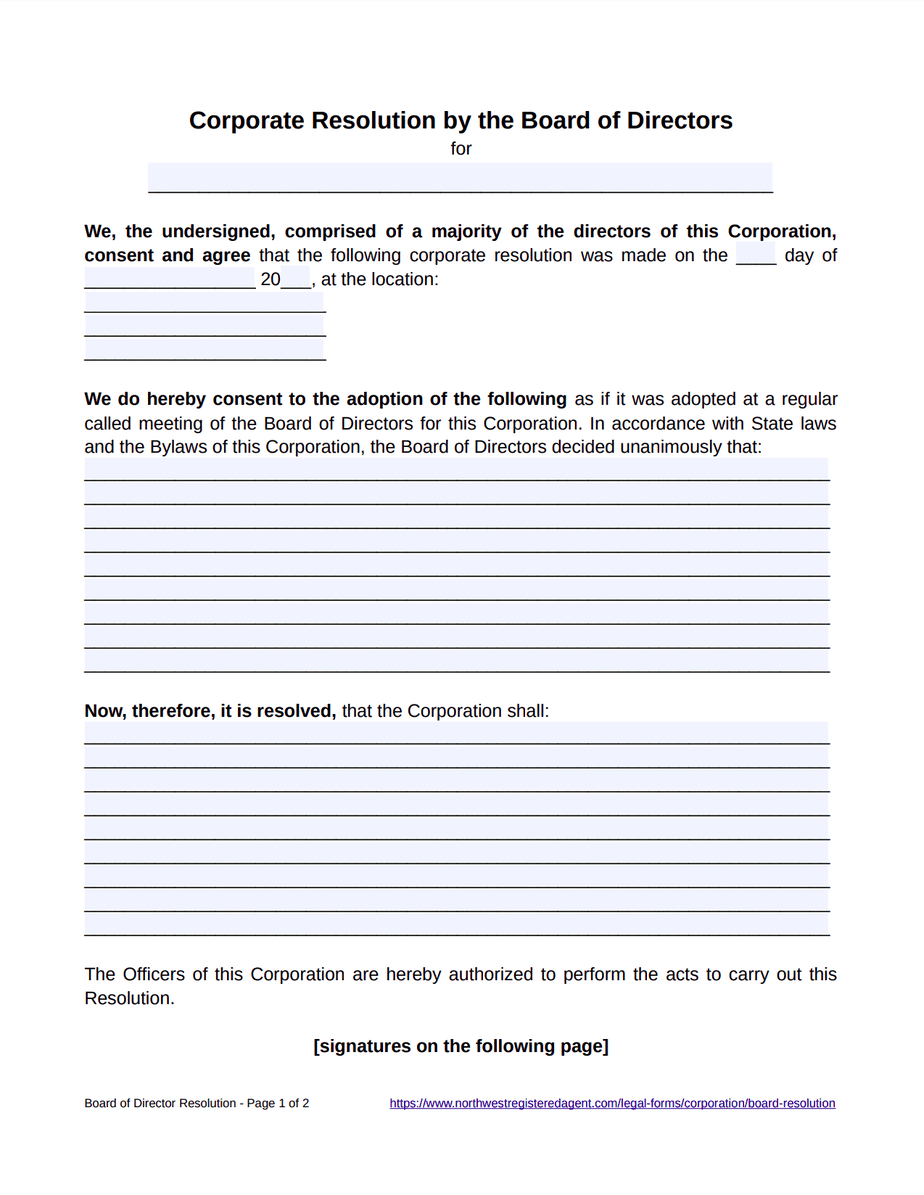

Board Of Directors Resolution Free Template

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

Personal Representatives Proof Of Claim Debts Paid P 3 1001 Pdf Fpdf Doc Docx

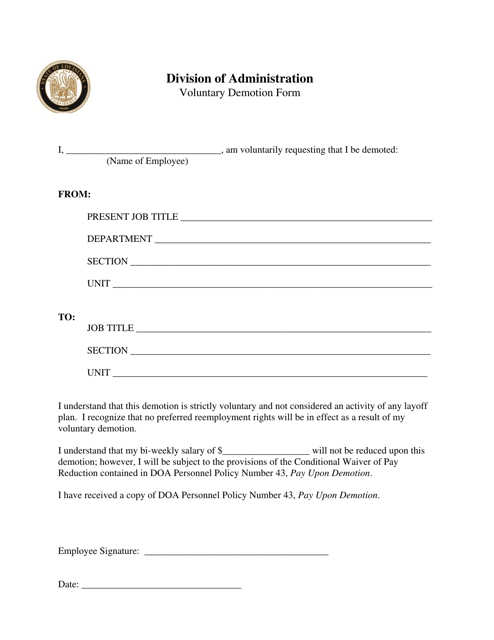

Louisiana Voluntary Demotion Form Waiver Of Pay Reduction Download Fillable Pdf Templateroller

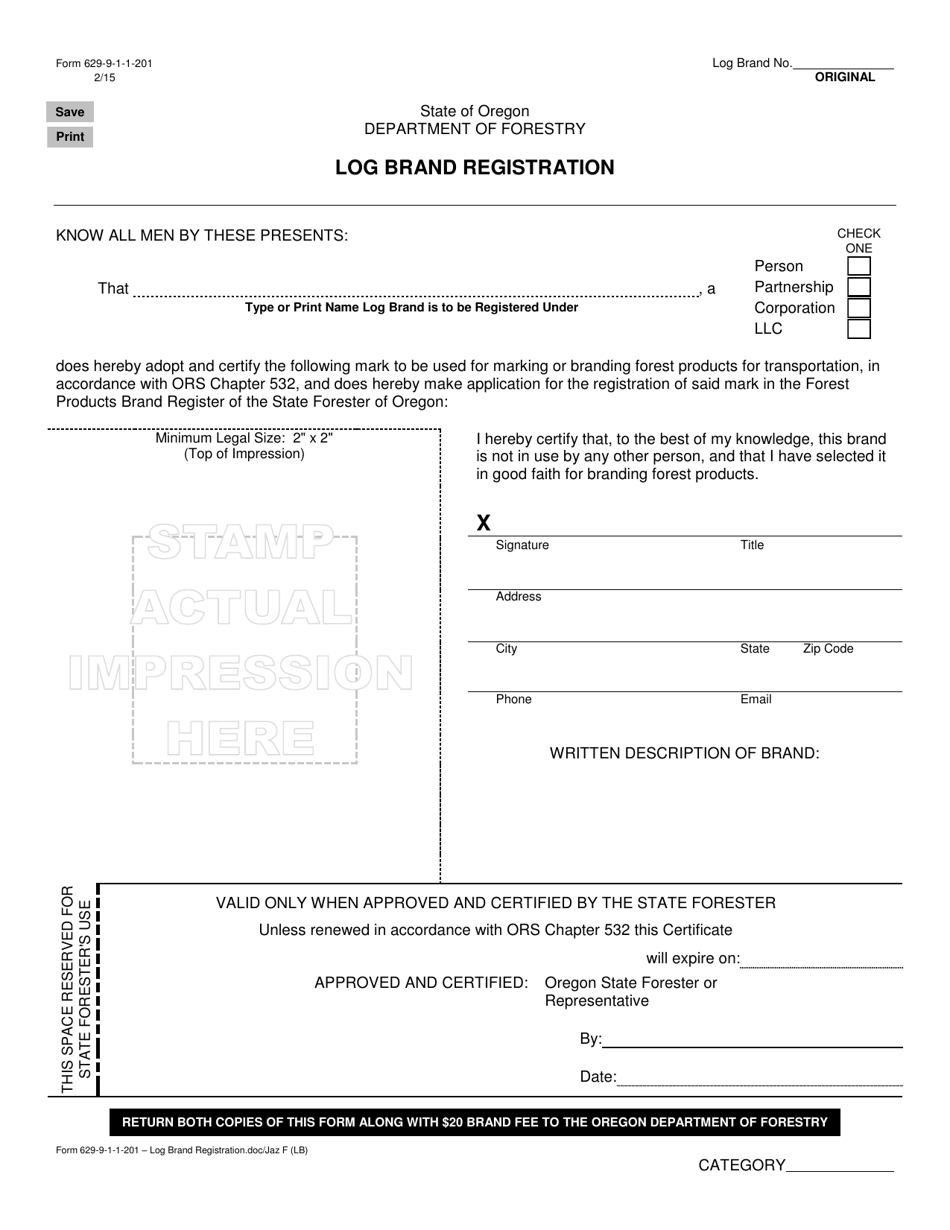

Form 629 9 1 1 201 Download Fillable Pdf Or Fill Online Log Brand Registration Oregon Templateroller

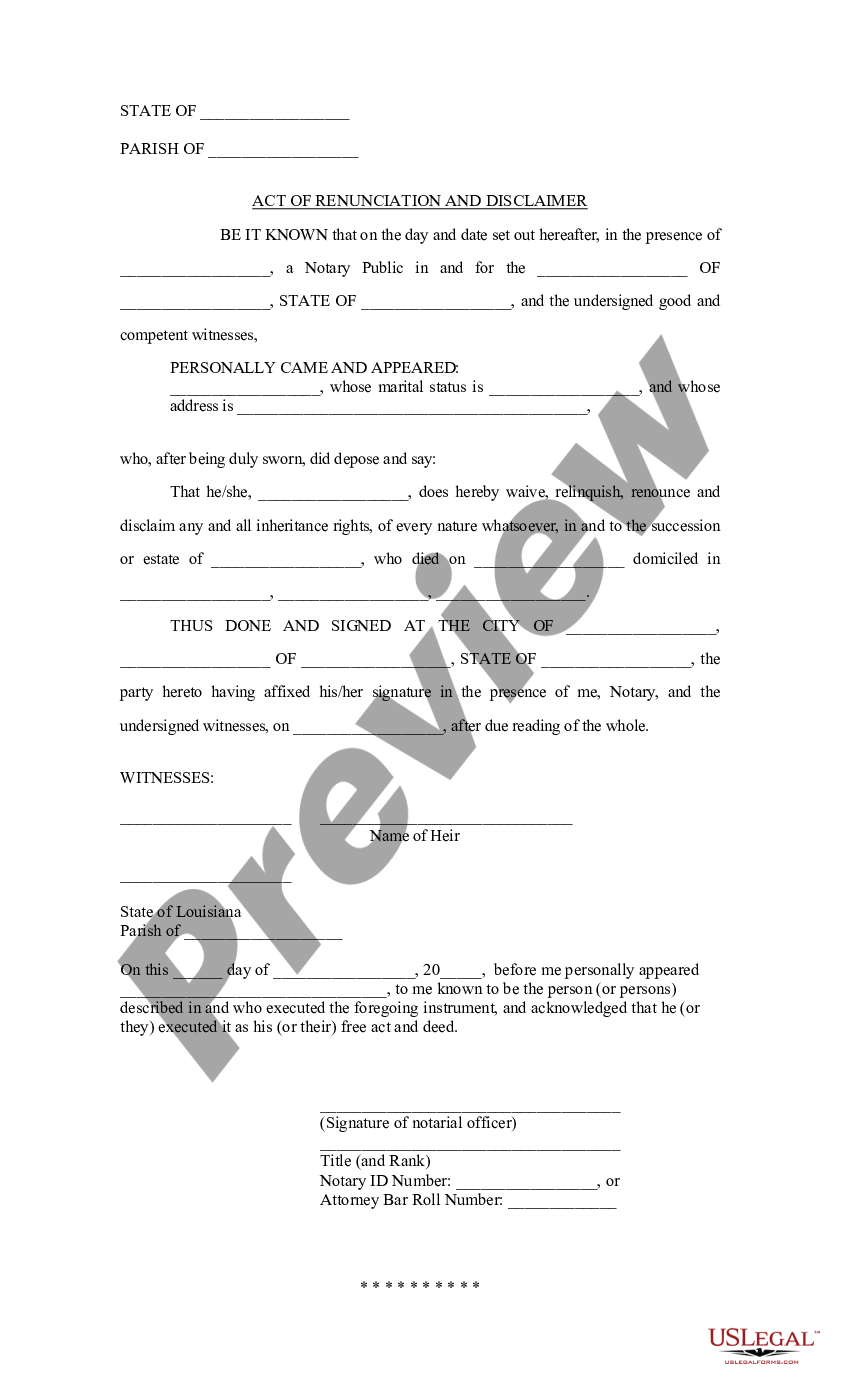

Louisiana Act Of Renunciation And Disclaimer Renunciation Disclaimer Renunciation Us Legal Forms

Freddie Mac Partial Release Form Fill Online Printable Fillable Blank Pdffiller

Nj Dot L 9 2019 2022 Fill Out Tax Template Online Us Legal Forms

Alabama Eviction Notice Free Printable Documents 30 Day Eviction Notice Eviction Notice Real Estate Forms

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Nj Form It R Fill Online Printable Fillable Blank Pdffiller

Free Rent Landlord Verification Form Word Pdf Eforms

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

Louisiana Inheritance Tax Estate Tax And Gift Tax

Petition For Certificate Releasing Liens Pc 205b Pdf Fpdf Docx Connecticut

Free Direct Deposit Authorization Form Pdf Word Eforms

Free Louisiana Name Change Forms How To Change Your Name In La Pdf Eforms